- Uneesa Finance

- Posts

- FINAL SALE - Learn to invest in just 4 weeks

FINAL SALE - Learn to invest in just 4 weeks

Your weekly investment tea🧋📈

Hey there! My name is Uneesa, and if I had to give myself a Forbes 2-page spread, the headline would read “I love God, women and money.”

Why? Well, other than loving God, women, and money. I want to help as many women as possible take financial control.

Join me as I’ll be holding your hand through the bold, new world of finance, and helping to demystify finance by asking 'WTF is this?'

EID DEALS - CLAIM YOURS NOW

OFFERS EXTENDED BC I FORGOT TO PUT IT ON SOCIALS

Invest in Yourself - A 4 week crash course in halal finance, PLUS a bonus live Q&A session! Best of all you get to go at your own pace and follow along in your own time. For Eid, I’m offering the course at a flat rate of £150 PLUS a FREE coaching session. BOOK NOW BEFORE TICKETS GO!

Finesse your Finances is back for another financial bootcamp! If you’re new to finance and looking to develop a deeper understanding of the issues that affect or may affect you - with practical tips shared, sign up here! Courses start at just £80 for a 5 week course - that’s just 16 quid a session!

My FREE Zakat session is still available with all donations going to MAP, Sudan Relief Fund and local charities in the UK. The session will be on demand so you’ll be free to catch-up in your own time iA.

N.B: Both courses are ideal for a 🇬🇧/🇺🇸 audience. If you’re based in the 🇦🇪/🇸🇦/🇶🇦/🇧🇭/🇴🇲, please get in touch for a bespoke cause dedicated to the GCC. ❤️

WTF HAPPENED to the stock market THIS WEEK? 🗞️💁🏻♀️

Today’s market performance

Last week, technology company stocks had a big surge, which helped the S&P 500 and NASDAQ bounce back from a three-week slump. This surge in tech stocks was so strong that it managed to outweigh concerns about recent economic and inflation news. The S&P 500 ended the week 3% higher, and the NASDAQ performed even better, finishing with a strong gain of over 4% for the week.

Similarly, Dubai Financial Market (DFM) had a strong performance this week, rallying significantly. The index gained 7.67% over the week, closing at 1,632.27. This surge in the index reflects broad strength across the market, with 28 stocks advancing and only three declining - though analysts are warning of a potential price correction in the near future, due to the upward price trends.

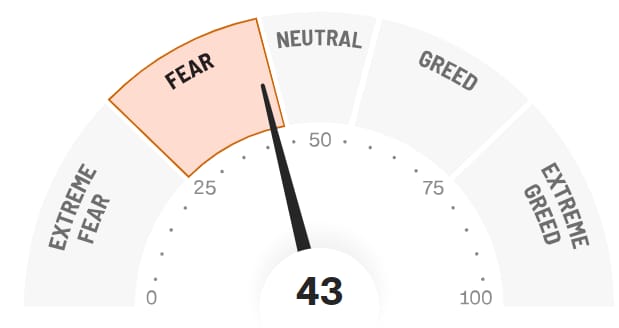

This week’s Greed vs Fear

What does it mean? |

Right now, certain stocks are making investors worried, which can confuse people who are new to investing. Although the overall market seems steady at the moment, it's important to consider safer ways to invest, especially when many people are feeling scared about the market. Remember that different industries can act in different ways, so it's smart to take your time and get advice if you're not sure what to do next.

So what are the updates?

I’ll be talking all things financial habit-hacking and getting intentional with your money on 25th May in Dubai. Roll thru if you’re around!

🧋FINANCIAL TEA🧋

ICYMI here’s this week’s highlights:

🪙 Binance ex-CEO and once a crypto’s saviour, Changpeng Zhao, has been sentenced to 4 months in prison, after pleading guilty to money laundering in the US. Binance has also been ordered to pay $4.3B after a US investigation found it helped users bypass sanctions.

🇦🇪🇪🇬 Egypt signed a deal with the UAE for a hefty $35M investment on the med coast over the next 2 months. As a result, Egypt’s sovereign dollar bonds soared.

📈 Tesla's stock price went up a lot because of news that Chinese officials are likely to give their okay for Tesla's driver-assistance system to be used in China. Also, there's talk of Tesla bringing out a less expensive car later this year, which has made investors feel more confident.

What to look out for in the coming week -

Focus is now on the U.S. central bank’s policy decision due at 6pm BST. The Fed is expected to hold its benchmark interest rate steady at 5.25% to 5.5%. Financial markets have already scaled back bets on the amount on U.S. policy easing likely this year and are now only fully pricing in one U.S. rate cut before December.

TWEET OF THE WEEK

Have you noticed how we’re still able to afford things despite how ridiculously expensive they keep getting? Allah kenan.

— Noor• (@Safaaraah)

11:13 AM • Apr 30, 2024